What if the FED cuts 50?

Markets head into the FOMC with expectations of a 25bp cut, but a surprise 50bp move, though unlikely, could signal deeper economic weakness and spark an equities sell-off while boosting Gold and long-dated treasuries.

Share your aspirations, and we’ll design a solution that drives you forward

Share your goals, and we will design the path to achieve it

Insights and analysis from financial experts on current market conditions and investment strategies

Markets head into the FOMC with expectations of a 25bp cut, but a surprise 50bp move, though unlikely, could signal deeper economic weakness and spark an equities sell-off while boosting Gold and long-dated treasuries.

The market’s breakout to new highs is challenging weak macro fundamentals, raising the question of whether this rally reflects a genuine turnaround or a temporary disconnect driven by AI-led earnings strength.

Gold’s blistering 25% two-month rally, driven largely by surging ETF inflows rather than fundamentals, is now showing signs of exhaustion, making it a good moment to book gains and wait for a healthier reset before re-entering.

Amid accounting concerns and a delayed 10-K, SMCI faces uncertainty despite its strong position in the AI data center boom. Investor caution advised.

Gold breaks out of a four-month range, fueled by Fed easing expectations, inverse correlation with interest rates, and technical momentum.

As rate cuts approach, growth concerns loom larger than inflation. Historical trends show equities often decline when the Fed starts easing.

Stay informed with daily updates on market movements, economic shifts, and key financial news.

In-depth financial education to navigate the complexities of finance.

Learn how to holistically assess your financial landscape, define clear financial goals, and prioritize them strategically. Discover actionable steps to align your wealth with your life’s aspirations.

Risk mitigation strategy assumes that individual assets do not move in perfect correlation with each other.

Explore the three stages of the financial lifecycle—creation, preservation, and transfer—and discover the vital role of wealth management in today’s evolving market.

Founder of Lighthouse Canton, with a strong background in finance and technology, following leadership roles at Citigroup and Credit Suisse.

Fintech and product leader with 13+ years of experience. Drives innovation, execution, and scale across digital wealth platforms through sharp strategy, systems thinking, and a deep understanding of investor needs.

Over 35-year career in investment, consistently delivering results in global markets and now applying expertise to wealth management with precision and client focus.

Over 20 years of HR leadership experience in IT services, focusing on global initiatives, talent development, diversity, and using technology to drive efficiency and people-centric practices.

A seasoned professional with 15 years in financial institutions, experienced in leading teams, driving strategic initiatives, and establishing product-market fits across the wealth management industry.

Financial operations expert with two decades at firms like Goldman Sachs, driving transformative initiatives in trading, compliance, and technology implementation.

Experienced leader in driving client growth and portfolio strategies, with a passion for leveraging data and digital tools in the HNW segment.

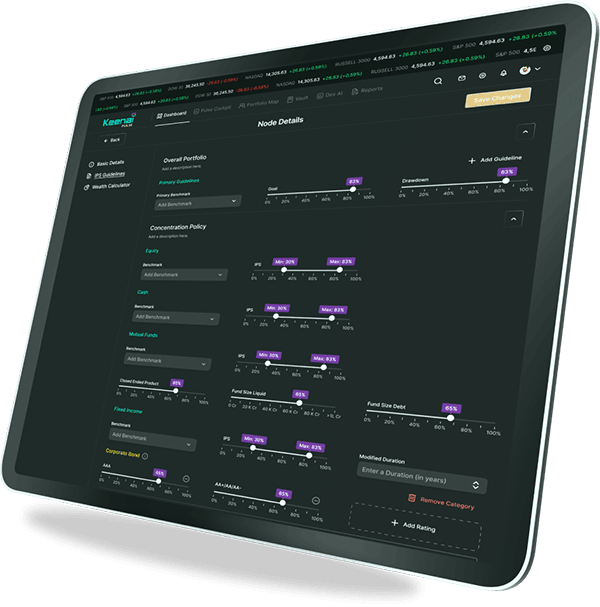

Pulse is a portfolio consolidation solution designed specifically for Single Family Offices (SFOs). It aggregates end-of-day transactions from all custodians and advisors, providing a unified view of all investments and deep insights into portfolio performance.

Pulse is built exclusively for Single Family Offices (SFOs) to help streamline portfolio management, simplify reporting, and enhance decision-making with advanced analytics.

Pulse helps SFOs by consolidating all investments into a single platform, providing a near real-time unified view. It offers advanced analytics, AI-driven insights, secure document storage, and customizable notifications to optimize portfolio management.

"*" indicates required fields